by Oscar Zuniga | Feb 27, 2026 | Uncategorized

When people review their homeowners insurance policy, they often focus on the larger numbers—the cost to rebuild the house or the total for personal liability. However, there is a smaller, often overlooked component called Medical Payments to Others (frequently...

by Oscar Zuniga | Feb 20, 2026 | Uncategorized

In an era where digital operations are the backbone of most industries, the conversation around data security has shifted. It is no longer just a concern for major corporations; businesses of all sizes often find themselves navigating a landscape of digital risks....

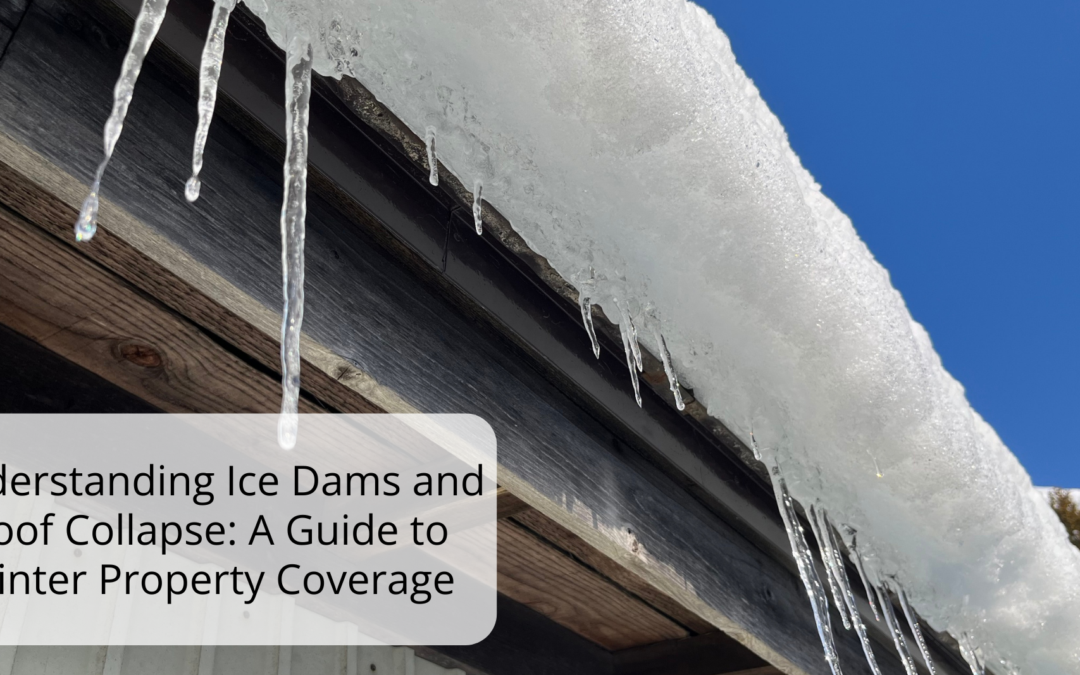

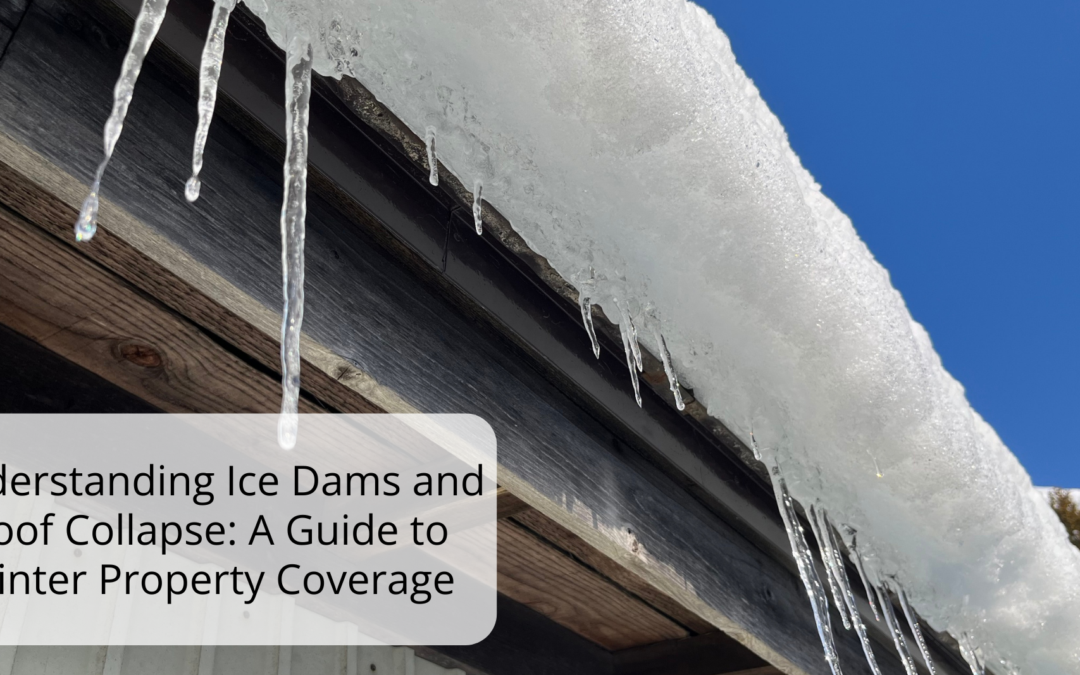

by Oscar Zuniga | Feb 13, 2026 | Uncategorized

Winter weather can place significant stress on a home’s structure. Between the sheer weight of accumulated snow and the slow creep of ice buildup, the roof is often the most vulnerable point of a property during the colder months. Understanding how homeowners’...

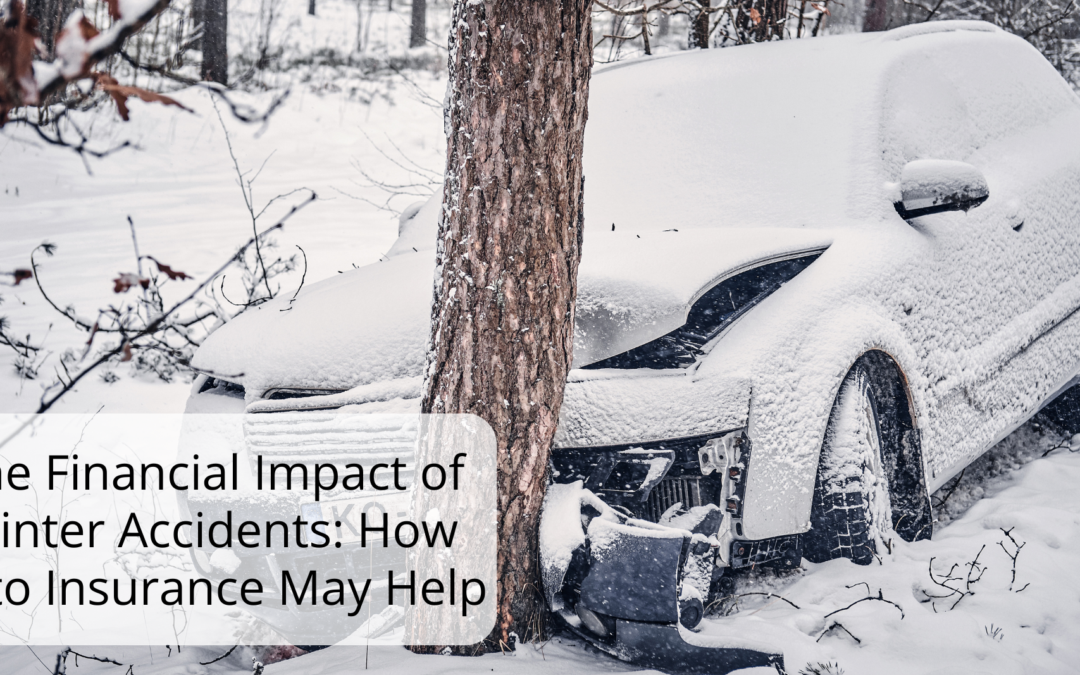

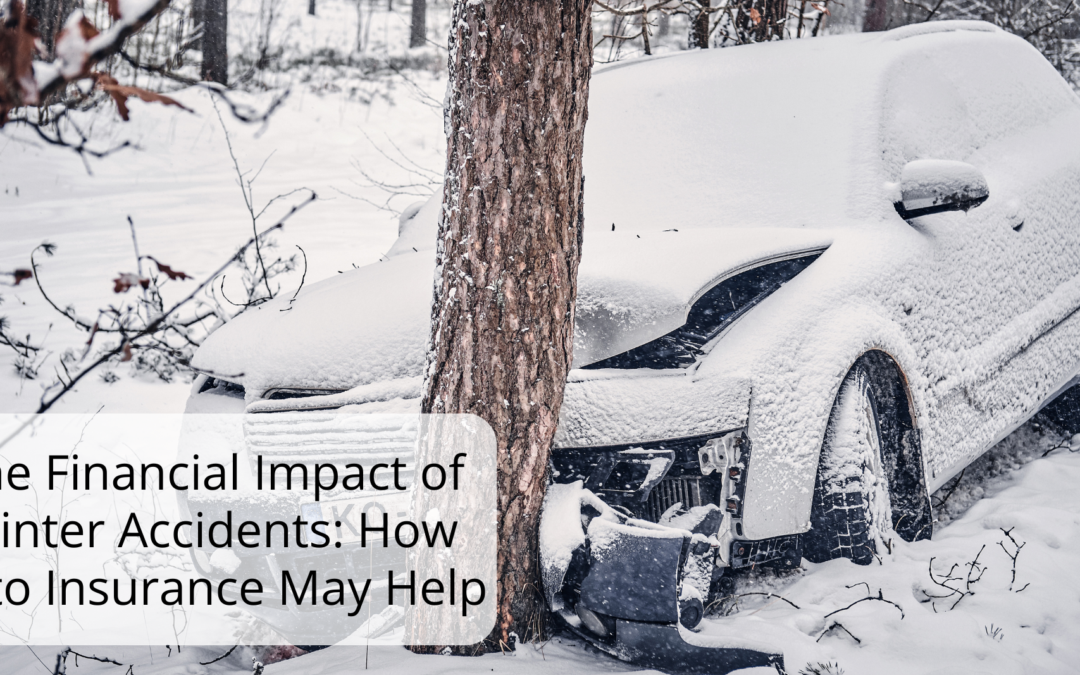

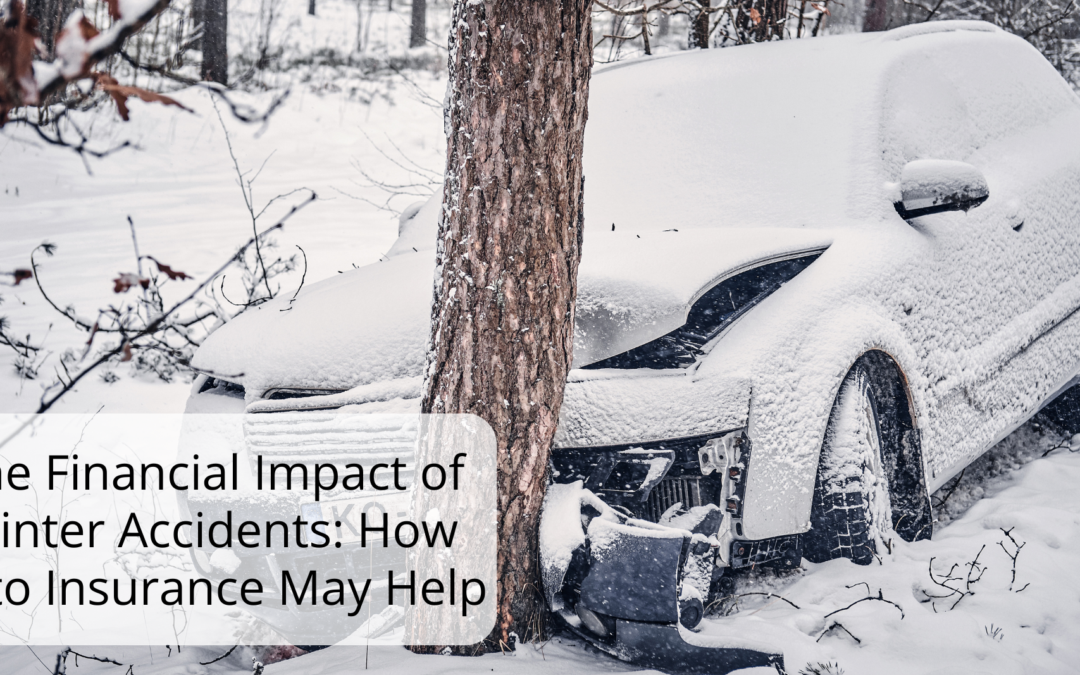

by Oscar Zuniga | Feb 6, 2026 | Uncategorized

Winter weather can transform a familiar commute into a challenging experience. Between black ice, reduced visibility, and heavy snowfall, the risk of road incidents typically increases during the colder months. Beyond the immediate stress of an accident, the potential...

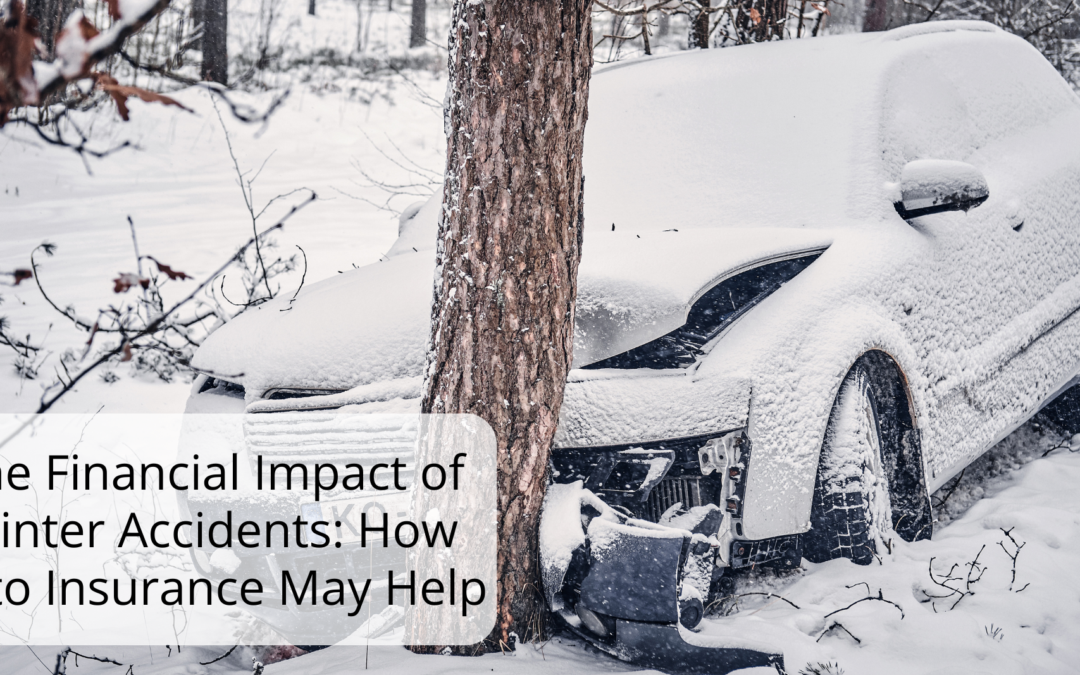

by Oscar Zuniga | Feb 6, 2026 | Uncategorized

Winter weather can transform a familiar commute into a challenging experience. Between black ice, reduced visibility, and heavy snowfall, the risk of road incidents typically increases during the colder months. Beyond the immediate stress of an accident, the potential...

by Oscar Zuniga | Jan 30, 2026 | Uncategorized

A home inventory is a detailed list of personal belongings that can help homeowners and renters keep track of what they own. While it may not be something people think about often, creating and maintaining a home inventory can make the insurance process easier if a...